Bitcoin Reclaims Intra-Day After Morning Plummet

블록스트리트 등록 2024-11-26 16:43 수정 2024-11-26 16:43

BTC Futures Market Liquidation Recorded $550 million

Liquidation 70% 'Upward Bet'...Recovered to $94,000

Altcoin Stops Rising Following BTC Dive On Nov. 26

Experts Reveal Mixed Prospects Over BTC Surge

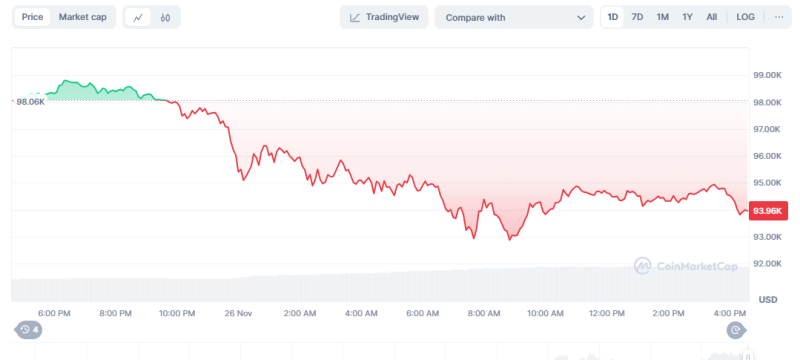

Bitcoin plunged about 4.8% and touched $93,000 on the morning of Nov. 26 due to a large-scale liquidation in the futures market.

According to data released by cryptocurrency hedge fund Merkel Tree Capital, about $550 million was liquidated in the bitcoin futures market on the morning of Nov. 26. About 70% of the liquidation is in long positions, with large-scale liquidation of funds from futures investors who bet on further Bitcoin rise.

Bitcoin, which plunged, recovered to $94,000 in the afternoon.

After a weekend of soaring altcoins due to Bitcoin's plunge, altcoins stopped rising. Only some altcoins rose.

◇Bitcoin = Bitcoin price is $93,965 at 4:30 p.m. on Nov. 26, 2024. The Bitcoin share(dominance) was 58.73%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 56.63% and 43.37%, according to the on-chain analytics platform Sigbtc.

Experts interpreted Bitcoin's sharp decline in the morning.

Matt Marley, a market strategist at investment firm Miller Tabak, said, "Now that we've tested the $100,000 level, we need to catch our breath for a while."

"This is U.S. holiday week, and prices may be difficult to maintain current levels in the absence of buyers such as MicroStrategy," said Shiliang Tang, CEO of trading firm Arbelos Markets.

On the other hand, Ryan McMillin, director of investment in Merkel Tree Capital, explained, "When Bitcoin soared horribly after Trump's election as U.S. president, there was a number of $100,000 left in all investors' minds, and this number of $100,000 caused a large-scale long position and a large-scale ambush."

"Considering that Bitcoin rose about $8,100 last week, the decline in Bitcoin is just a healthy adjustment," he pointed out.

Nick Foster, founder of DeFi derivatives protocol Dlive, also explained, "The adjustment that occurred on the 26th is not unusual in the bull market. Bitcoin's rise, which began to rise due to expectations from the U.S. interest rate cut cycle and regulatory framework, is not expected to turn off easily."

◇ Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Nov. 26 was Moss Coin(MOC), which rose about 60%.

MOC is a cryptocurrency used in a virtual game platform called Mosland. Mosland is an online real estate game made from virtual landmarks all over the world, allowing players to buy and sell virtual real estate inside Mosland, just like the game called Burumabul. At this time, the currency used in real estate transactions is Moscoins.

Moscoin is an Ethereum (ETH)-based ERC-20 coin, and rather than using its own blockchain technology, it is selectively utilizing other advanced blockchain technologies.

◇Fear Greed Index = The cryptocurrency fear-greed index provided by Alternative has entered the phase of 'extreme greed' with 79 points. Extreme greed is an upward phase accompanied by high volume and strong volatility. It can be said that it is a selling section for institutions as it is highly likely to leave the market at its peak.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 41.3, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr