Bitcoin Continues To Break New Reports On Additional Buy By Whales

블록스트리트 등록 2024-12-17 16:42 수정 2024-12-17 16:42

CryptoQuant "40,000 BTC Sold on OTC in a Month"

Altcoin, BTC Unlike Rally, Shows Different Moves

Experts Reveal Different Forecasts Over BTC Price

Whales with large amounts of bitcoin have been found to be continuing to buy bitcoin. Michael Saylor, founder of MicroStrategy, said on Dec. 16 that he purchased 15,350 additional bitcoin through his X account. When converted into dollars, the price is about $1.5 billion.

CryptoQuant chief analyst Julio Moreno also explained in his X account that "the number of Bitcoin on the OTC desk balance has decreased by about 40,000 since November 20." The OTC desk is the main window for institutional investors to buy Bitcoin, and the decrease in the volume of Bitcoin in the OTC desk means that the demand for institutional investors to buy Bitcoin is increasing.

As Bitcoin continued to break new highs, altcoins made somewhat mixed moves. While some altcoins recorded double-digit gains, major altcoins went sideways.

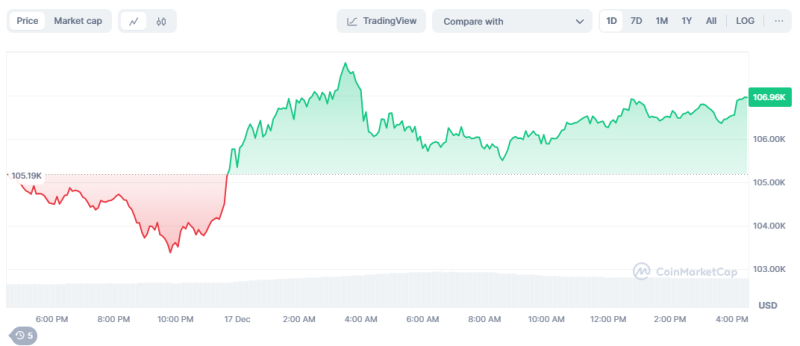

◇Bitcoin = Bitcoin price is $106,966 at 4:30 p.m. on Dec. 17, 2024. The Bitcoin share(dominance) was 57.85%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 39.20% and 60.80%, according to the on-chain analytics platform Sigbtc.

As Bitcoin continues to break new highs, experts' prospects surrounding Bitcoin have been mixed.

"Bitcoin will reach $180,000 in 2025," predicted Matthew Siegel, head of cryptocurrency research at U.S. asset manager VanEck.

On the other hand, BCA Research predicts that the U.S. economy will enter a recession next year, suggesting that Bitcoin prices could plunge by nearly 60% in the future. The draft sent by BCA Research to customers said, "Bitcoin prices could fall to $45,000 by the end of next year," and stressed, "If the economic downturn comes, a sharp decline will be made mainly by bitcoin and big tech companies."

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Dec. 17 was UXLINK, up about 15%.

UXLINK establishes a Web 3.0 social platform in which users participate to guarantee users full ownership and privacy of their data, identity, and social connections. It aims to overcome the limitations of existing social platforms by acting as a bridge between Web 2.0 and Web 3.0.

It supports various DApps and services that can be operated based on groups for users, and various APIs (application programming interfaces) and SDK (software development tools) that can utilize users' social data for developers. Users can easily create a UXLink account and invite acquaintances by using existing social media accounts such as Telegram. UXLink, UXLINK's native token, is used for payment and governance purposes within the platform.

◇Fear Greed Index = The cryptocurrency fear-greed index provided by Alternative has entered the phase of 'extreme greed' with 87 points. Extreme greed is an upward phase accompanied by high volume and strong volatility. It can be said to be a selling section for institutions due to the high possibility of leaving the market at its peak.

The cryptocurrency relative strength index (RSI) provided by Sigbtc was 72.2, which was 'overbought'. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of overbought and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr