Bitcoin Weakens On Jerome Powell Comment...The Decline in Altcoins Intensified

블록스트리트 등록 2024-12-19 17:08 수정 2024-12-19 17:08

Powell Awake up Trump's Crypto Dream at FOMC Press Conference

Markets Weakened On Serial Clearance Of Futures Markets

Altcoin Fails to Make Up for Fall Despite Afternoon Buying Inflows

Powell, who held a press conference following the FOMC regular meeting, declared a 0.25% rate cut, but poured cold water on Trump's roadmap. Asked about the plan to buy Bitcoin as a strategic asset, Powell replied, "The Fed cannot hold Bitcoin under the law," adding, "We will not seek to revise the law."

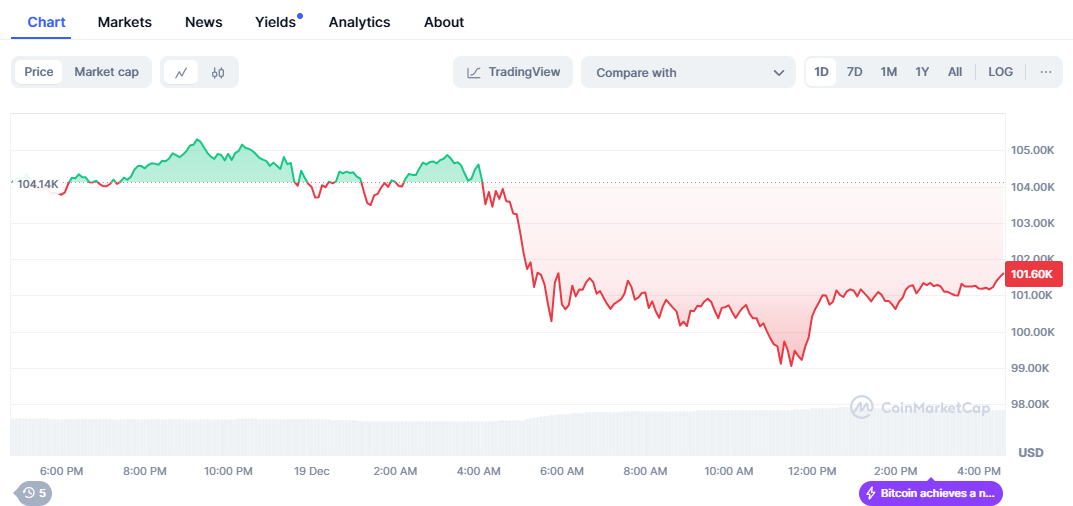

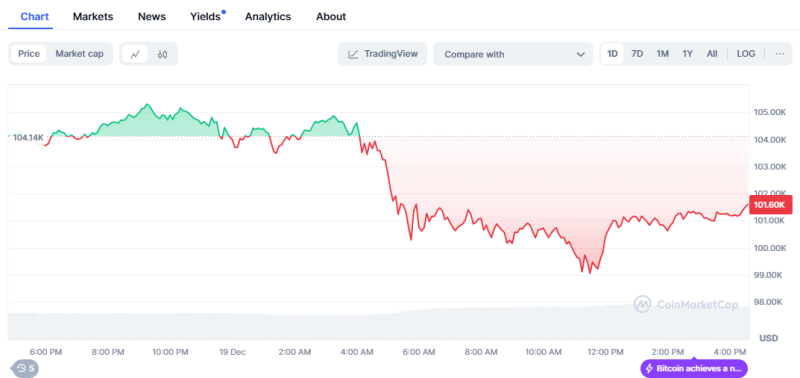

Bitcoin, which continued to march day by day due to Trump's declaration of support for Bitcoin, plunged from $104,000 to $101,000 with Powell's press conference.

Bitcoin's plunge caused a massive series of liquidations in the cryptocurrency futures market, which plunged the cryptocurrency market on the morning of Dec. 19. According to data from the on-chain analysis platform CoinGlass on Dec. 19, the amount of liquidation incurred in the cryptocurrency futures market was about $68.2 million. The number of futures investors who suffered forced liquidation was about 241,068.

After a sharp drop in the morning, low-priced buying in the afternoon pushed the cryptocurrency market to rebound, but a number of altcoins failed to make up for the drop, except for Bitcoin exceeding $100,000.

◇Bitcoin = Bitcoin price is $101,606 at 4:30 p.m. on Dec. 19, 2024. The Bitcoin share(dominance) was 58.20%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 56.81% and 43.19%, according to the on-chain analytics platform Sigbtc.

When bitcoin fell at Powell's words, experts expressed a rather cautious outlook on the strength of bitcoin. It is predicted that you should not look unconditionally at the rosy future.

"It is no surprise that the pace of interest rate cuts will slow down next year, but risky assets are being burdened," said David Rawant, research director at cryptocurrency brokerage Falcon X. "Most macroeconomic factors affect cryptocurrency prices, and the industry's own factors are likely to move the market over the next few months as the new administration's policy changes are expected."

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Dec. 19 was UXLINK, up about 27%.

UXLink establishes a Web 3.0 social platform in which users participate to guarantee users full ownership and privacy of their data, identity, and social connections. It aims to overcome the limitations of existing social platforms by acting as a bridge between Web 2.0 and Web 3.0.

It supports various DApps and services that can be operated based on groups for users, and various APIs (application programming interfaces) and SDK (software development tools) that can utilize users' social data for developers. Users can easily create a UXLink account and invite acquaintances by using existing social media accounts such as Telegram. UXLink, UXLink's native token, is used for payment and governance purposes within the platform.

◇Fear Greed Index = The cryptocurrency fear-greed index provided by Alternative has entered the 'greed' phase with 75 points. The Greed phase is a phase where price volatility and trading volume increase, and the price increases. As it is highly likely to form a short-term high, caution should be taken in selling.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 40.6, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr