Bitcoin Remains Flat After Huge Price Volatility

블록스트리트 등록 2025-01-14 16:54 수정 2025-01-14 16:54

BTC Hits $8.9M In Clearance Of $74.58M In Futures Market On Jan. 14

WP "Trump Administration to Order Pro-Cryptocurrency Administration"

BTC Takes Back $9.4K, Stretches Horizontal In The Day...Altcoin, Volatility ↑

Tom Lee "BTC May Face High Volatility After U.S. CPI Announcement"

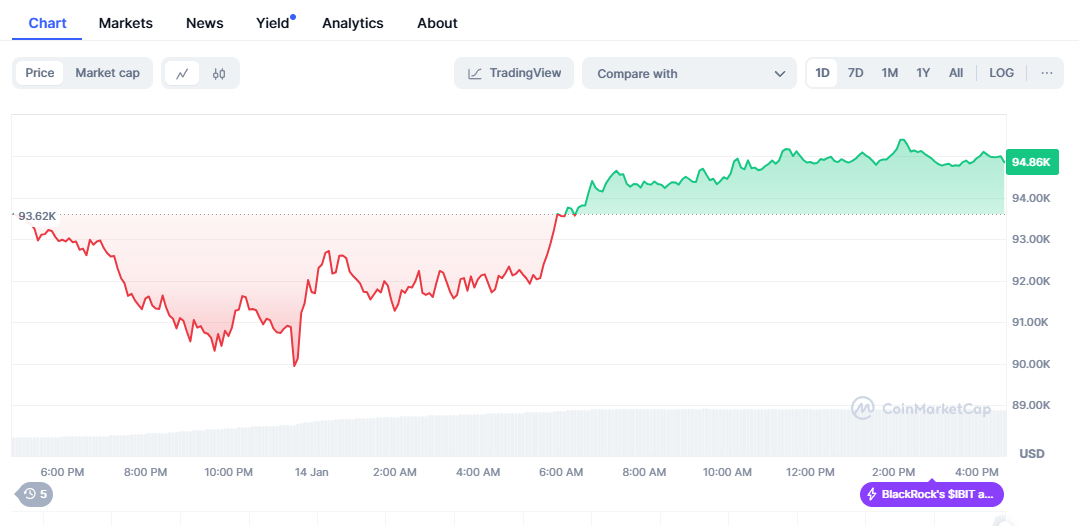

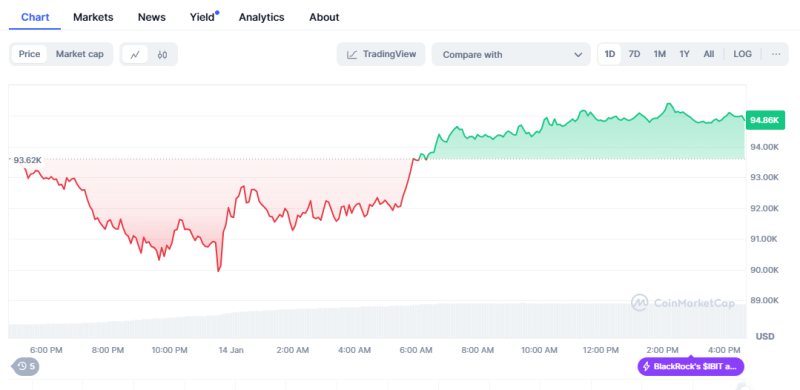

Bitcoin fell to $89,000 on a massive liquidation in the futures market on the afternoon of Jan. 13. According to data from the on-chain analysis platform CoinGlass on Jan. 14, liquidation in the futures market on the morning of Jan. 14 is about $74.58 million.

However, Bitcoin rebounded after the Washington Post reported the possibility of the Trump administration lifting the "SAB 121." SAB 121 is a regulatory guideline that states that when a bank or financial institution holds a cryptocurrency, it is considered a "debt" even if the cryptocurrency is a customer's cryptocurrency and must be entered in the financial statement. SAB 121 was evaluated as a major obstacle to banks and financial institutions' adoption of cryptocurrency.

Bitcoin, which recovered $94,000 in the morning, continued to move sideways from $94,000 during the day.

Due to the strong economic indicators in the U.S., the prediction that the Fed could freeze interest rates has increased the volatility of altcoins, which are "risk assets." Altcoins have recorded large increases and decreases without any particular consistency.

◇Bitcoin = Bitcoin price is $94,866 at 4:30 p.m. on Jan. 14, 2025. The Bitcoin share(dominance) was 58.46%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 57.98% and 42.02%, according to the on-chain analytics platform Sigbtc.

It has been revealed that Bitcoin will suffer from sharp price volatility in the short term.

Tom Lee, Chief Investment Officer (CIO) of Fundstrat Capital, told CNBC on Jan. 13 that he expected a scenario in which Bitcoin rebounded after falling to $70,000.

"We're in the very early stages of our half-life cycle right now," said CIO Li, "Bitcoin will be one of the best performing assets of the year, so buying Bitcoin in the near term is a big opportunity."

"People who buy for $90,000 will not lose money in the long run," he said.

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Jan. 14 was UXLINK, up about 14.42%.

UXLink establishes a Web 3.0 social platform in which users participate to guarantee users full ownership and privacy of their data, identity, and social connections. It aims to overcome the limitations of existing social platforms by acting as a bridge between Web 2.0 and Web 3.0.

It supports various DApps and services that can be operated based on groups for users, and various APIs(application programming interfaces) and SDK(software development tools) that can utilize users' social data for developers. Users can easily create a UXLink account and invite acquaintances by using existing social media accounts such as Telegram. UXLink, UXLink's native token, is used for payment and governance purposes within the platform.

◇Fear Greed Index = The cryptocurrency fear-greed index provided by Alternative has entered the 'Greed' phase with 63 points. The Greed phase is a phase where price volatility and trading volume increase, and the price increases. As it is highly likely to form a short-term high, caution should be taken in selling.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 53.9, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr