Bitcoin Falls on Wait-And-See Approach Ahead of U.S. FOMC Meeting

블록스트리트 등록 2025-03-18 16:31 수정 2025-03-18 16:31

Markets "U.S. Fed to Freeze Interest Rates After FOMC Meeting"

BTC, Altcoins Fall Intra-Day On Exhaustion of Buying By Market Vigilance

Ju Ki-young "BTC Ends Rising...6 to 12 Months Sideways or Down"

Markets are raising public opinion that the Fed will freeze its key interest rate through a FOMC meeting. After last month's FOMC meeting, a number of key Fed figures, including Fed Chairman Jerome Powell, left comments signaling a rate freeze.

Concerns that the market could be engulfed in large volatility if the Fed announces a rate freeze after the FOMC meeting led to a depletion of buying in the market.

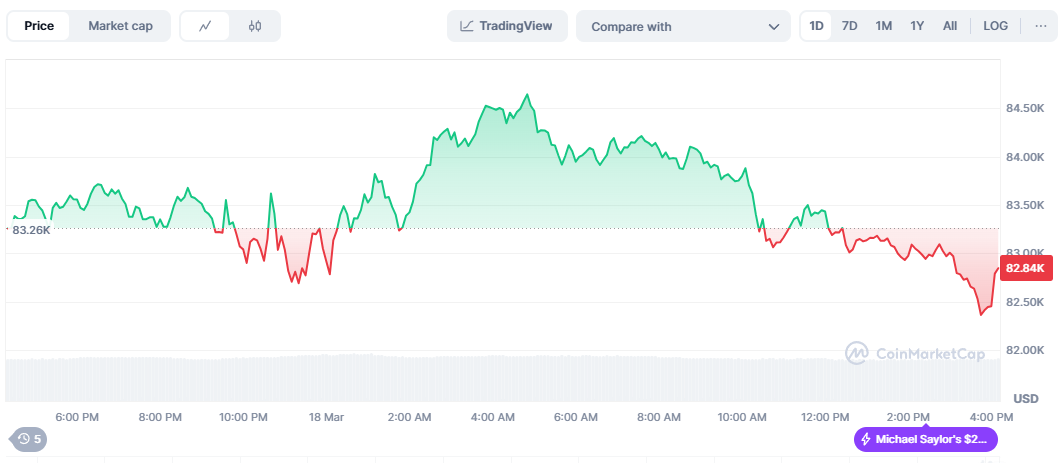

A number of altcoins fell about 2% on Mar. 18, including a 1.4% drop in Bitcoin during the day.

◇Bitcoin = Bitcoin price is $82,845 at 4:30 p.m. on Mar. 18, 2025. The Bitcoin share (dominance) was 61.68%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 63.00% and 37.00%, according to the on-chain analytics platform Sigbtc.

CryptoQuant CEO Ju Ki-young predicted that Bitcoin's uptrend has ended based on a number of on-chain data and that Bitcoin will continue its sideways or downward trend for about 6-12 months in the future.

The data attached by Representative Joo is a long-overdue graph of Bitcoin buying and selling. The Bitcoin long-overdue signal data attached by Representative Joo indicated that the selling is currently dominant and that Bitcoin will fall.

In addition, CEO Joo analyzed the 365-day Bitcoin moving average line calculated by applying Bitcoin's 'Real Value versus Market Value(MVRV)', 'Holder Income Status(SOPR)' and 'Net unrealized Net Income(NUPL)'. "All on-chain indicators foreshadow a downtrend," he said. "As liquidity is depleted, Bitcoin whales are selling Bitcoin at low prices."

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Mar. 18 was Loom Network(LOOM), up about 30%.

Loom Network is a blockchain-based game platform. In order to solve the scalability problem of Ethereum-based DApps, different side chains are operated for each DApp to reduce the overload of the main chain and support large-scale DApp development.

Loom network token(LOOM) is used to host deposits and dapps on the chain.

◇Fear Greed Index = Digital asset fear-greed index provided by Alternative maintains a 'Fear' level with 34 points. The fear phase(20-39) is a phase where cryptocurrency price volatility and trading volume increase, and the price falls. Since there is a high possibility of forming a low point in the short term, one should be careful about buying.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 43.6, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr