Bitcoin Faces 'Black Monday' Following Recession Fear

블록스트리트 등록 2025-04-07 17:02 수정 2025-04-07 17:02

BTC Plunges On Sale, Futures Market Liquidation on Morning

BTC Keeps Decline Following Asian Stock Market Plunges

'Dangerous Assets' Altcoin Deepens Downward Than BTC

Experts "BTC Will Flow Different with U.S. Stock Market"

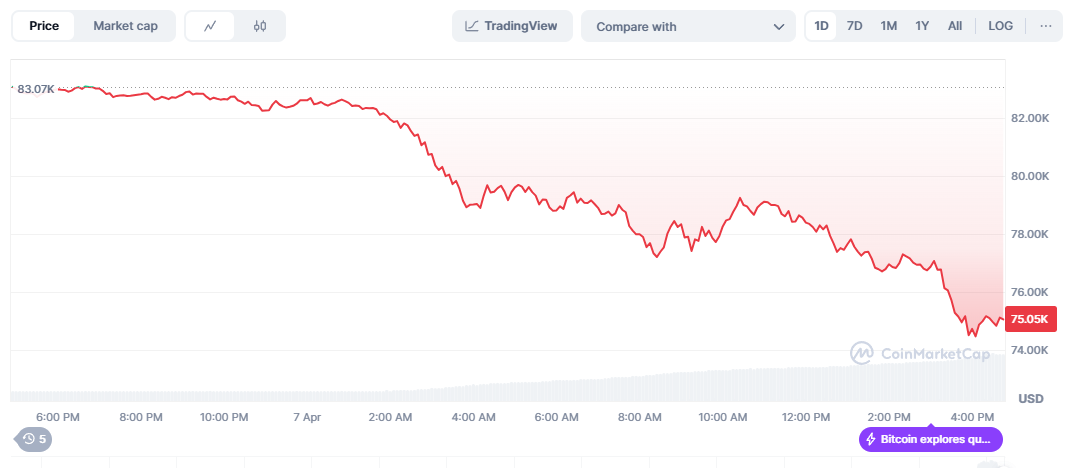

Bitcoin faced a frightening sell-off as soon as the 7th began, falling about 7% in the morning, with the sell-off coupled with a large clearing of the futures market.

According to data from the on-chain analysis platform Coinglass at 9 a.m. on the 7th, the liquidation of the bitcoin futures market totaled about $1.2 billion, of which the liquidation of long(rising) bets was about $700 million.

Bitcoin, which rebounded to $79,000 on low-priced buying that flowed into the market in the morning, fell again due to the plunge in Asian stocks.

The Asian stock market closed with a sharp decline and a sharp decline with the opening of the market on Apr. 7.

China's Shanghai Composite Index dropped 7.34% and Hong Kong's Hang Seng Index dropped about 12.55%, including Japan's Nikkei 225 that ended the day with a 7.83% drop. The local bourse is no exception. The KOSPI and KOSDAQ ended the session down about 5.57% and 5.25%, respectively.

Bitcoin fell again amid the Asian stock market crash, falling to $75,000 at 4 p.m.

Altcoins also fell weak on Bitcoin's decline. Binance Coin(BNB) fell about 10% and Ethereum(ETH) fell about 6%, including Solana(SOL) down about 18%.

◇Bitcoin = Bitcoin price is $75,055 at 4:30 p.m. on Apr. 7, 2025. The Bitcoin share(dominance) was 63.69%.

The long (up) and short (down) betting ratios in the Bitcoin futures market stood at 67.26% and 32.74%, according to the on-chain analytics platform Sigbit.

Despite Bitcoin's decline, experts claim that Bitcoin will show decoupling (decoupling) with the U.S. stock market and rallying.

Arthur Hayes, CEO of BitMex, claimed on his X account on the 4th that the problems caused by the tariff war would lead to currency issuance, which would trigger a rise in Bitcoin.

Popular trader Crypto Caesar left a message on his X account on the 4th that seemed to predict the current situation. Posting the Bitcoin forecast graph, he said, "Bitcoin may fall first, but we will soon see it enter an upward cycle after that."

Popular trader Crypto Elite also said on his X account on the 6th that "Bitcoin is preparing for a rally next week," adding, "The rise that will surpass $150,000 is just about to begin."

◇ Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Apr. 7 was Cobak Token(CBK), up about 40% on the day alone.

Cobak Token(CBK), which began its service launch in March 2018, is the world's first project that combines community and blockchain wallet. It is a token that is received as a reward for various activities at Covax, which has about 330,000 users.

Cobak is a community platform that allows users to check cryptocurrency investment information and market prices. Cobak Tokens can be received by users as much as they contribute to the service and can be used as a payment method within the ecosystem.

◇Fear Greed Index = The digital asset fear-greed index provided by Alternative maintains a 'Fear' level with 23 points. The fear stage(20-39) is a stage where cryptocurrency price volatility and trading volume increase, and the price falls. Since there is a high possibility of forming a low point in the short term, one should be careful about buying.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 48.2, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr