Bitcoin Surges On Trump's Tariff Moratorium Announcement

블록스트리트 등록 2025-04-10 16:32 수정 2025-04-10 16:32

Trump Announces "Decided to Extend Tariffs by 90 Days After Talks"

"Imposing Only 10% of Basic Tariff Rates...Will Start Talking to China"

Top 3 U.S. Stocks Are Rising All-Time...Coin Jumps in the Morning

BTC Continues $820,000...Altcoins Multiple Up More Than 10%

"We have negotiated with more than 75 countries and will postpone the imposition of tariffs on them by 90 days," President Trump said on his social media "Truth Social" on Apr. 10. He also said that he will apply only 10% of the basic tariff rate to 75 countries for 90 days.

In Trump's post, the asset market continued to rise for 10 days after soaring. In particular, the continued surge in the asset market was interpreted as the peak of the tariff war based on President Trump's follow-up remarks.

"I witnessed people's anxiety," President Trump said in the Oval Office on Apr. 10. "We have considered applying only 10% of the basic tariff rate over the past few days and have implemented it."

Referring to retaliatory tariffs, China said, "I don't think we should do more," adding, "Xi Jinping is my friend and I like and respect him, so I will meet with him and have a conversation."

U.S. stocks posted record-high gains. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite closed up about 7.87%, 9.52%, and 12.16%, respectively.

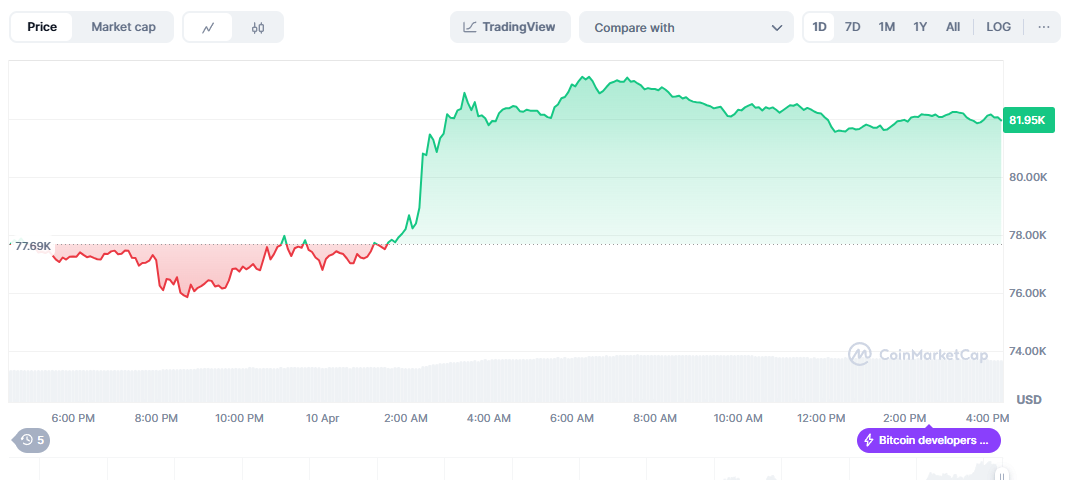

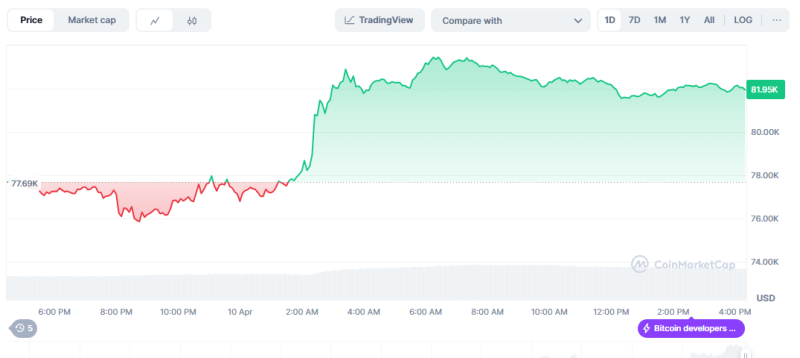

Along with the rise of the U.S. stock market, bitcoin and altcoins surged from the early morning of the 10th and continued to rise during the day.

Bitcoin, which surpassed 83,000 dollars, remained at the 82,000 dollar level. The "risk asset" altcoins surged. The majority of altcoins rebounded about 5%, including about 10% each for Ethereum(ETH), Solana(SOL), Dogecoin(DOGE), and ADA.

◇Bitcoin = Bitcoin price is $81,955 at 4:30 p.m. on Apr. 10, 2025. The Bitcoin share(dominance) was 63.47%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 48.58% and 51.42%, according to the on-chain analytics platform Sigbtc.

There was an opinion that the tariff war would lead to Bitcoin's rise.

Matt Hougan, general investment manager of Bitwise, predicted the transformation of the global monetary system due to the weakening of the U.S. dollar and the rise of Bitcoin, predicting that Bitcoin will hit $200,000 at the end of this year.

Hougan stressed that the Trump administration is currently changing the order of the global monetary system, which will give alternative reserve assets such as bitcoin and gold an opportunity. "Governments and companies have relied on dollars in international trade due to the stability of the dollar, but as soon as the dependence of the dollar collapses, other alternative assets will be in the spotlight," he said.

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Apr. 10 was Gas(GAS), up about 32% on the day alone.

Gas is Neo's 'satellite' coin and is the native token of the Neo blockchain. Neo is called the 'Chinese version of Ethereum' and is a 'DeFi platform' holding coin that can perform smart contracts. All blocks in the Neo blockchain generate more than a certain amount of gas, which is used as a fee for the implementation and operation of Neo smart contracts.

◇Fear Greed Index = Digital asset fear-greed index provided by Alternative maintains a 'fear' level with 39 points. The fear stage (20-39) is a stage where cryptocurrency price volatility and trading volume increase, and the price falls. Since there is a high possibility of forming a low point in the short term, one should be careful about buying.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 57.2, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr