Bitcoin Is Ready to Break ATH in the Spotlight as s 'Safe Asset'

블록스트리트 등록 2025-05-21 16:32 수정 2025-05-21 16:32

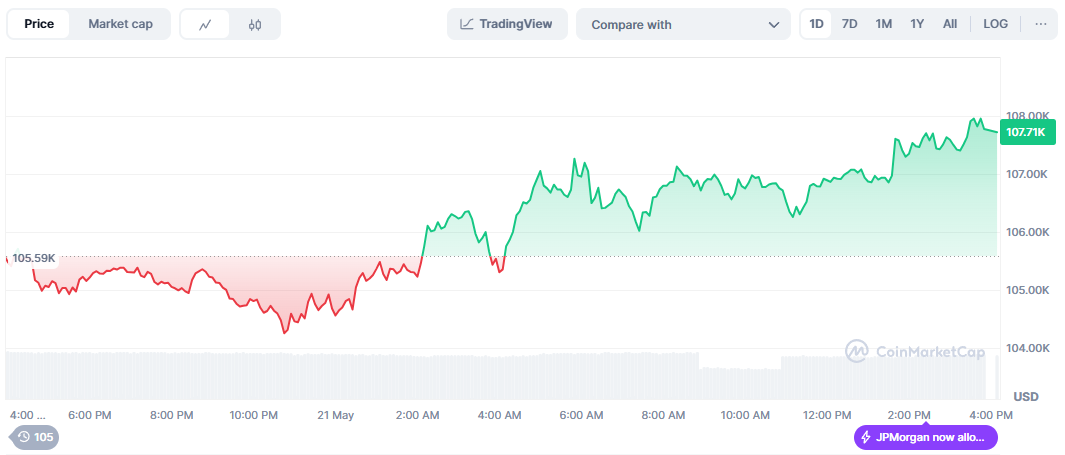

BTC Breaks $107,000 Intra-Day On Increased Market Buying

Experts "BTC Is on Rise by Healthy Buying in Global Exchange

Glassnode "Pointing for Volatility as Futures Market Open Interest"

The analysis revealed that healthy buying in the market led to the inflow and the rise of Bitcoin.

Avocado Onchain, a researcher at the on-chain analysis platform CryptoQuant, analyzed in a report published on May. 21 that orders from major global exchanges are gradually rising, leading to the rise of Bitcoin. He said that the past two overheats have led to a long-term adjustment, but now they are different from then.

Global asset management company Swiss Block also announced that the Bitcoin Fundamental Index(BFI) remains neutral even when it is about to break through its all-time high as a result of on-chain analysis.

Bitcoin rose to $107,000 on the afternoon of May. 21, and it was on the verge of a new high. Bitcoin's highest price is $108,786 which was recorded on Jan. 20.

With Bitcoin's rise, many altcoins also rose more than 2%, creating a typical uptrend.

◇Bitcoin = Bitcoin price is $107,716 at 4:30 p.m. on May. 20, 2025. The Bitcoin share(dominance) was 63.94%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 33.62% and 66.38%, according to the on-chain analytics platform Sigbtc.

Based on the outstanding agreements accumulated in the futures market, data has been released asking people to pay attention to Bitcoin's large price volatility.

Glassnode, an on-chain analysis platform, announced on the 20th that the outstanding interest in the bitcoin futures market recorded about $72 billion.

Open interest refers to the amount that can be used to settle transactions in the derivatives market, such as futures or options contracts. An increase in open interest can mean a large-scale liquidation of certain positions in the futures market.

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on May. 20 was Mantra(OM), up about 28% on the day alone.

Mantra was a native token of the layer 1 project mantra specializing in asset tokenization(RWA) and was a huge hit based on the community. In April, Mantra experienced a huge crash in which its market capitalization evaporated by about 6 trillion won overnight, raising suspicions of a "rug pool" inside and outside the market. Rug pool refers to the act of a cryptocurrency developer intentionally damaging a project he or she has developed and then stealing funds invested in the project.

At the time, John Mullen CEO dismissed the allegations of lug pools of Mantra tokens as just a rumor.

◇Fear Greed Index = Digital asset fear-greed index provided by Alternative has entered the 'greed' phase with 70 points. The greed phase is a phase where price volatility and trading volume increase, and the price increases. The government should be cautious about selling products as it is highly likely to form a short-term high.

The cryptocurrency relative strength index(RSI) provided by Sigbit was 65.9, which was in a 'neutra' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of a measure of over-purchasing and over-selling of a particular asset.

권승원 기자 ksw@blockstreet.co.kr