Glassnode "BTC Eases Selling after $112,000 Touch"

"Short-Term Investors' Sell-Off Has Stabilized"

Altcoin Hits Over 2% Intra-Day Higher On BTC Move

It has been analyzed that Bitcoin has sold as much as short-term investors have sold due to its recent decline. Glassnode, an on-chain analysis platform, pointed out in a report published on the 7th that the sale of Bitcoin by short-term holders began to ease when the price of Bitcoin touched $112,000 on the 5th.

According to data from Glassnode, about 70% of short-term investors in Bitcoin are making a profit.

Altcoins rose as short-term investors' selling declined and Bitcoin remained stable. Major altcoins remained strong, including a rise of about 2% in Ethereum (ETH) and XRP.

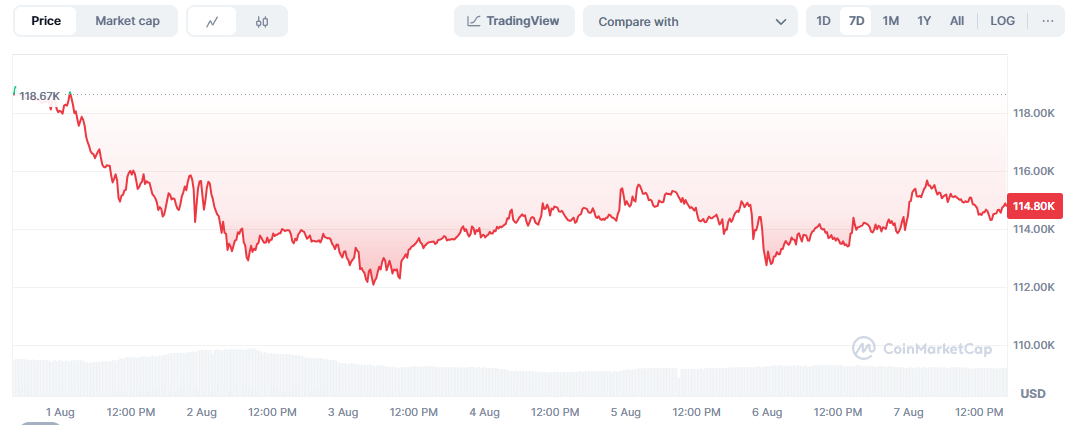

◇Bitcoin =Bitcoin price is $114,802 at 4:30 p.m. on Aug. 7, 2025. The Bitcoin share(dominance) was 61.55%.

The long(up) and short(down) betting ratios in the Bitcoin futures market stood at 57.11% and 42.89%, according to the on-chain analytics platform Sigbtc.

Based on Bitcoin's demand for buying and selling the spot market, an analysis has been raised that Bitcoin's price has now stabilized.

Glassnode explained that the Bitcoin market is now starting to balance with the profits and losses of Bitcoin holders evenly distributed. "With 70% of short-term holders making profits, this means that the market situation is very balanced and there will be no major volatility for the time being," Glassnode said.

◇Upward Coin = The cryptocurrency that recorded the largest increase from the previous trading day at 4:30 p.m. on Aug. 7 was Omni Network(OMNI), up about 5% on the day alone.

Omni Network is a Layer 1 blockchain that provides interoperability between Ethereum roll-ups developed to solve liquidity, fragmentation of users, developers, and others caused by the rapid increase in the number of roll-ups.

It is explained that it aims to process cross-chain transactions quickly and efficiently through Dual Chain Architecture and Integrated Consensus. In addition, it has the characteristic of securing the stability of the initial protocol by having an Ethereum-derived security system through ETH restaking as an active validated service (AVS) of the EigenLayer.

◇Fear Greed Index = The digital asset fear-greed index provided by Alternative has entered the 'neutral' stage with 54 points. The neutral stage is a section where the psychological resistance and support of market participants appear, and important decision-making actions appear in future price movements.

The cryptocurrency relative strength index(RSI) provided by Sigbtc was 51.8, which was in a 'neutral' state. RSI sets the relative strength between the upward and downward pressure of a particular asset price and is an indicator of the over-purchase and over-sale of a particular asset.

권승원 기자 ksw@blockstreet.co.kr